Investors should probably credit CEO John Fieldly for their massive returns in Celsius Holdings (CELH 4.84%) stock. Under his leadership, the beverage company moved from relative obscurity to one of the most successful energy drink companies.

Such benefits have accrued to shareholders, especially those who bought Celsius stock in April 2018 when Fieldly became CEO. Its results show that investing in the right leader can benefit companies and investors alike.

The growth of Celsius stock

If one had invested $1,000 in Celsius stock in April 2018, that holding would be worth around $18,600, as of the time of this writing. This approximate 1,760% gain far outpaces the S&P 500 (^GSPC 0.53%), which has earned a total return of just under 160% during that time.

CELH Total Return Level data by YCharts

Under Fieldly’s leadership, Celsius has stood out in two ways. First, it emphasizes natural ingredients in its energy drinks, deriving caffeine from guarana extract, a plant-based alternative. This nature-based approach helped the company develop a following within the fitness community.

Second, a distribution deal with PepsiCo in 2022 helped it gain coveted shelf space with the world’s largest retailers. Today, Costco and Walmart‘s Sam’s Club have emerged as prominent sellers, and many consumers buy the product from Amazon.

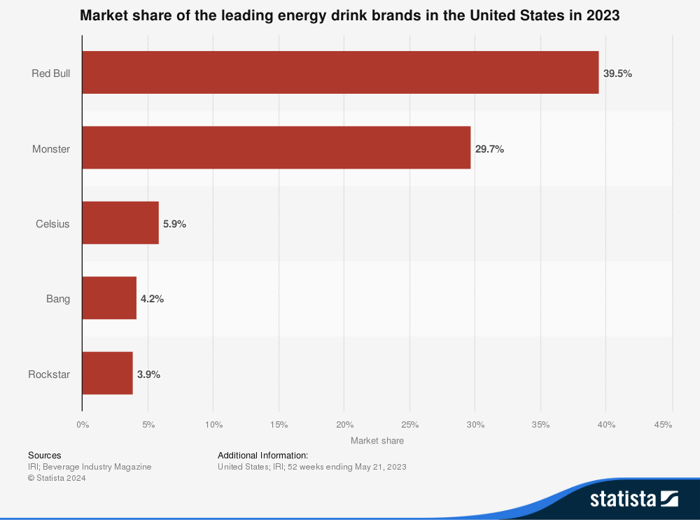

Consequently, Celsius is now the third-most popular energy drink, lagging behind only Red Bull and Monster Beverage.

Data source: Statista.

Are investors too late?

Despite the massive gains, Celsius investors may have a unique buying opportunity. A slowdown in purchases from a prominent distributor (likely PepsiCo) has led to a nearly 75% drop in share prices. Revenue growth for the first three quarters of 2024 was only 5% yearly, well below the 102% annual revenue increase in 2023.

That slowdown may make investors leery of its 39 P/E ratio. However, the company has considerable potential for international expansion, which was just 7% of revenue in Q3. If distribution evens out and the company can reignite growth, investors who bought in April 2018 and held could see further gains beyond their $18,600.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Celsius, Costco Wholesale, Monster Beverage, and Walmart. The Motley Fool has a disclosure policy.