Though investors’ attention is now mostly focused on President Donald Trump’s tariffs and trade wars, the tech sector’s quantum computing race is still going on. Yet that shift in focus away from the promising technology could actually be the very thing that allows investors to get in on some of the hottest quantum computing stocks at more reasonable valuations as they were trading at high premiums just a few months ago.

One of the pure-play leaders in this space is IonQ (IONQ 12.78%). It has inked several key partnerships and is adding more on a monthly basis. On the other hand, it’s also far from reaching profitability and is a long-shot pick. So is it worth investing in now?

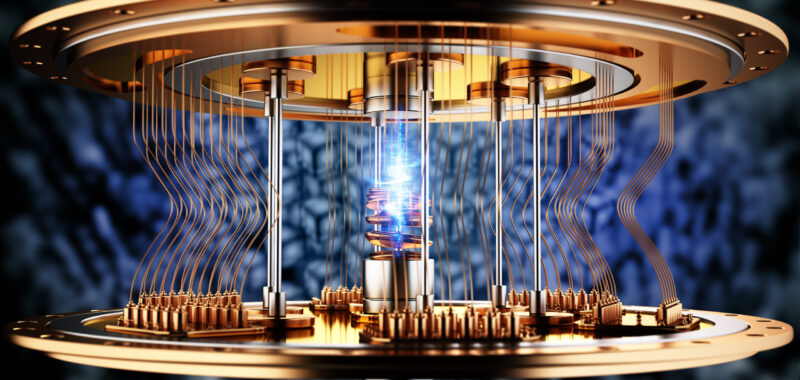

Quantum computing is an incredibly difficult technology

IonQ is attempting to solve the same core problems that every competitor in the quantum computing arms race is attempting to solve: preventing and correcting errors. Unlike traditional computers, quantum computers inherently produce a lot of errors. Traditional computing transmits and stores data in simple binary form — 0s and 1s — known as bits. And the electromagnetic mediums it uses to do that — tiny transistors — are stable and reliable, so unless something changes it on purpose, a 1 almost always stays a 1.

Quantum computing uses qubits, in which data can exist as 0s and 1s, but can also exist as complex probability amplitudes between 0 and 1 as the computer works toward the answer to whatever problem it has been set to solve. The upside is that this makes quantum computing a powerful tool for rapidly solving certain types of enormously complex problems.

The downside is that qubits are extremely fragile and susceptible to interference and noise; even with the best protection they can be given today, outside forces can and do turn some of those 1s into 0s, and vice versa. The result: errors — and far too many of them. The ultimate winners in this space will be the companies that can crack this problem reliably and cost-effectively at scale, and provide solid value to their clients.

IonQ has made great progress in this area. Its machines now have a 99.9% native gate fidelity, which is a measure of how closely the quantum computer’s result matches the proper result. The company expects to increase that percentage to greater than 99.9% in 2025 and 99.95% in 2026.

As for a timeline for when IonQ will become a functional business, CEO Peter Chapman predicted that it would be profitable by 2030 and have sales approaching $1 billion. Right now, IonQ is basically running off of research grants and contracts, so actual sales will be a welcome change for investors.

But would the prospect of IonQ generating around $1 billion in sales by 2030 make it enough of a value prospect to invest in now?

IonQ is fighting an uphill battle

Currently, IonQ sports a $6.2 billion market capitalization. So it’s trading in 2025 at a valuation of 6.2 times its forecast 2030 sales. That price-to-sales ratio isn’t necessarily expensive when applied to a company that’s selling high-margin products, but as a premium for a company that hasn’t generated any legitimate system sales yet, it seems like a stretch.

Furthermore, that $1 billion sales figure is just a projection; it may not pan out. Worse, IonQ could get beaten to the punch by a competitor, especially since tech powerhouses like Alphabet and Microsoft are also competing in this field and have nearly unlimited resources to throw at their R&D efforts.

As a result, IonQ is a long-shot pick to succeed in its space. I don’t have an issue with investing in companies like this, but when buying shares, you should keep the relative size of such a position small — say, less than 1% of your total portfolio value. That way, if the stock goes to zero, it won’t damage your overall returns too much.

But if the company succeeds, that small initial investment can grow to something much larger. IonQ is a strong competitor in the quantum computing arms race, but its success is far from certain.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.