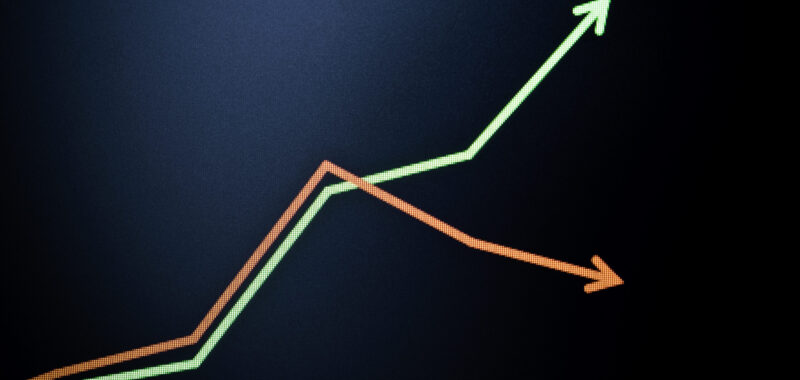

No company made both lists, but one industry has held on strong for the past four decades.

Greek philosopher Heraclitus is credited with saying, “Change is the only constant in life.” Although he lived thousands of years ago, this quote is still relevant today, even in the business world.

In just the past 40 years, we’ve seen the business and investing world completely transform, resulting in a changing of the guard of the world’s biggest publicly traded companies (by revenue). Here’s a look at what has changed over the past four decades.

The biggest companies in 1984

| Company | Revenue in 1984 |

|---|---|

| ExxonMobil (XOM -0.16%) | $88.6 billion |

| General Motors (GM 0.63%) | $74.6 billion |

| Mobil | $54.6 billion |

| Ford Motor (F 0.72%) | $44.5 billion |

| International Business Machines (IBM 1.62%) (IBM) | $40.2 billion |

Source: Fortune 500. Revenue rounded to the nearest 10 million.

The one aspect that sticks out about that time was the dominance of oil and vehicles. IBM was the leading tech company, but it aside, oil and vehicles were the top dogs in town.

The biggest companies today

| Company | Revenue in the Past Four Quarters |

|---|---|

| Walmart (WMT 1.06%) | $657.3 billion |

| Amazon (AMZN 3.71%) | $604.3 billion |

| Saudi Arabian Oil (2222) | $495.4 billion |

| Sinopec (386 -0.57%) | $473.5 billion |

| PetroChina (PTR) | $430.7 billion |

Source: Fortune 500. Revenue rounded to the nearest 10 million.

The most noticeable aspect of today’s biggest companies is the rise of retail and technology (with Amazon in the sweet spot of the two). Oil continues to be a heavy-hitter because of the globe’s dependence, but consumers have shown they appreciate the one-stop-shop nature of companies like Walmart and Amazon.

Walmart has a stronghold on the brick-and-mortar side, and Amazon has revolutionized e-commerce. Will these companies be leading the pact 40 years from now? Only time will tell. One thing remains certain, though: Change is all but inevitable.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool recommends General Motors and International Business Machines and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.