The EUV lithography maker reported solid earnings, but general fears over the extended AI trade brought it down.

Shares of key semiconductor equipment supplier ASML Holdings (ASML 3.90%) fell 11.8% in July, according to data from S&P Global Market Intelligence.

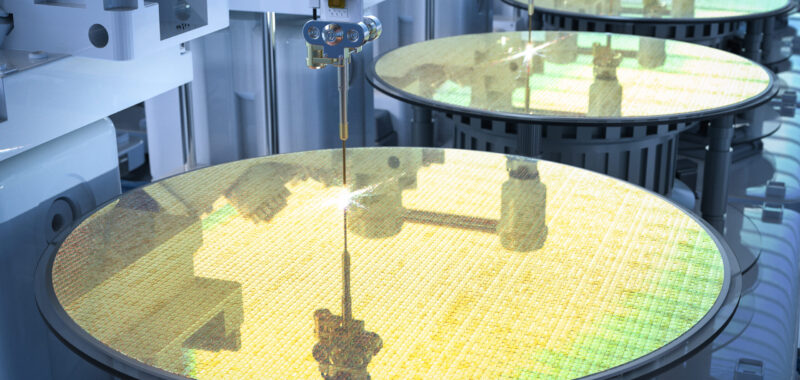

ASML makes extreme ultraviolet lithography (EUV) machines crucial to making cutting-edge semiconductors for artificial intelligence (AI) applications. So expectations were high heading into the month, with ASML up about 40% on the year heading into July.

So when ASML delivered solid but not extraordinary results, investors felt perhaps a bit let down. Around the same time as its earnings report, July 17, geopolitical concerns also came to the fore.

China concerns loom amid earnings

In the second quarter, ASML grew revenue 10.6% to 6.9 billion euros, while earnings per share grew 22.9% to 4.93 euros per share. Both numbers came in ahead of expectations. Yet bookings came in at only 4.5 billion euros, below overall revenue. That actually marked an increase from the prior quarter, but perhaps below expectations given the recent explosion of AI demand.

Moreover, geopolitical concerns loomed around the same time. On the same day as ASML’s earnings, reports circulated that the U.S. was considering even more export restrictions on chipmaking equipment to China. While ASML had already been prohibited from selling its advanced EUV machines to China, China’s Huawei was able to produce a 7-nanometer advanced chip last year, perhaps using less efficient double patterning with ASML’s less advanced deep ultraviolet lithography machines.

So worries abounded that the government would clamp down even more on ASML’s China sales. Of note, about 49% of ASML’s revenue came from China last quarter, although much of that is for trailing-edge specialty chips that probably wouldn’t be affected. No firm decision has been made on additional restrictions so far.

As a cherry on top, Republican presidential nominee and former president Trump raised concerns in an interview with Bloomberg Businessweek, with a statement that implied his backing of Taiwan against a potential Chinese invasion wasn’t ironclad. Since the majority of leading-edge chips and a lot of memory are produced in Taiwan, a potential war between China and Taiwan could lead to disaster for the semiconductor industry and likely the global economy.

ASML could be a bounce-back candidate

Despite these concerns, ASML is an indispensable company with a monopoly on the technology that makes AI possible. While bookings can be quite lumpy, ASML has always seen 2024 as a digestion year for the industry after customers added a lot of capacity through 2023. Meanwhile, ASML and numerous other chipmakers are quite bullish about the prospects of 2025. So as long as there are no geopolitical disasters, this pullback in AI winners seems like an opportunity to pick up more shares.